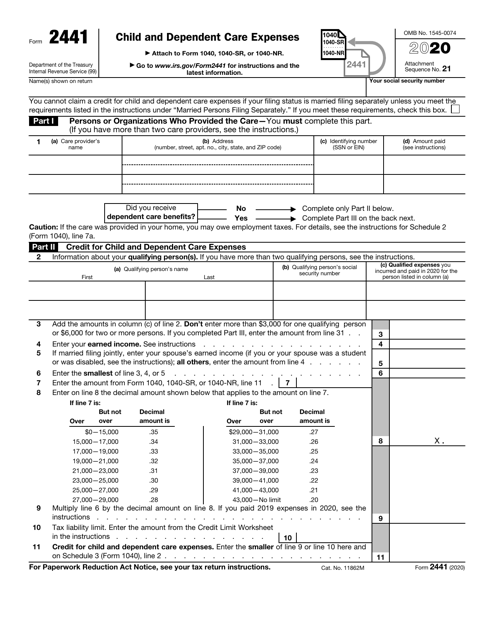

It is in addition to the credit for child and de-pendent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or. Use the Earned In-come Chart later twiceonce with 2019 amounts and once with 2020 amounts to see if your 2019 earned income is greater than your 2020 earned income.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Tax year 2019 for the following.

Irs child tax credit 2019 instructions. The child lived with you for more than half of 2019 see Exceptions to time lived with you later. For more information see the 2019 Instructions for Form 1040-NR or the 2019 Instructions for Forms 1040 and 1040-SR. Families with higher incomes who qualify for the 2000 credit will get monthly.

Have a Social Security Number SSN Be under 17 years of. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Previously parents received a tax credit of up to 2000 per child under age 17 at tax refund time.

A child tax credit CTC is a tax credit for parents with dependent children given by various countries. You can make this election if your 2019 earned income was greater than your 2020 earned income. Election to use your 2018 earned income to figure your 2019 additional child tax credit.

If you do not itemize your deductions you may be. For a child or stepchild of a qualifying widower for a qualifying relative for the child tax credit and for a person for whom the student loan interest deduction is claimed. The ACTC may give you a refund even if you do not owe any tax.

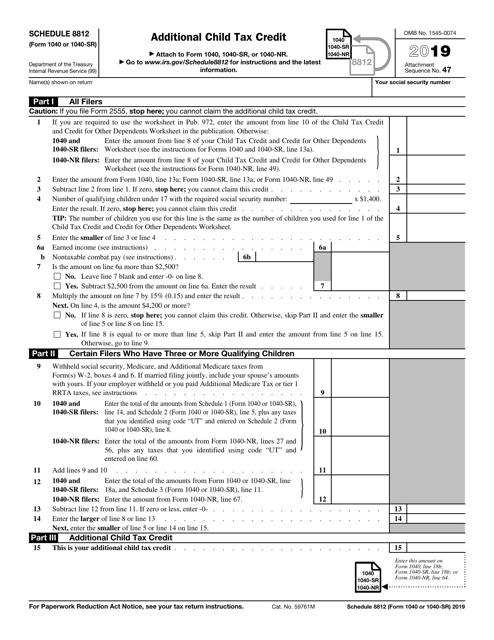

You only need to complete Part I if you are claiming the child tax credit for a child iden-tified by an IRS individual taxpayer identifi-cation number ITIN. You do not need to complete Part I of Schedule 8812 for any child that is identified by a social securi-ty number SSN or an IRS adoption taxpay-er identification number. The American Rescue Plan Act raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children between ages 6.

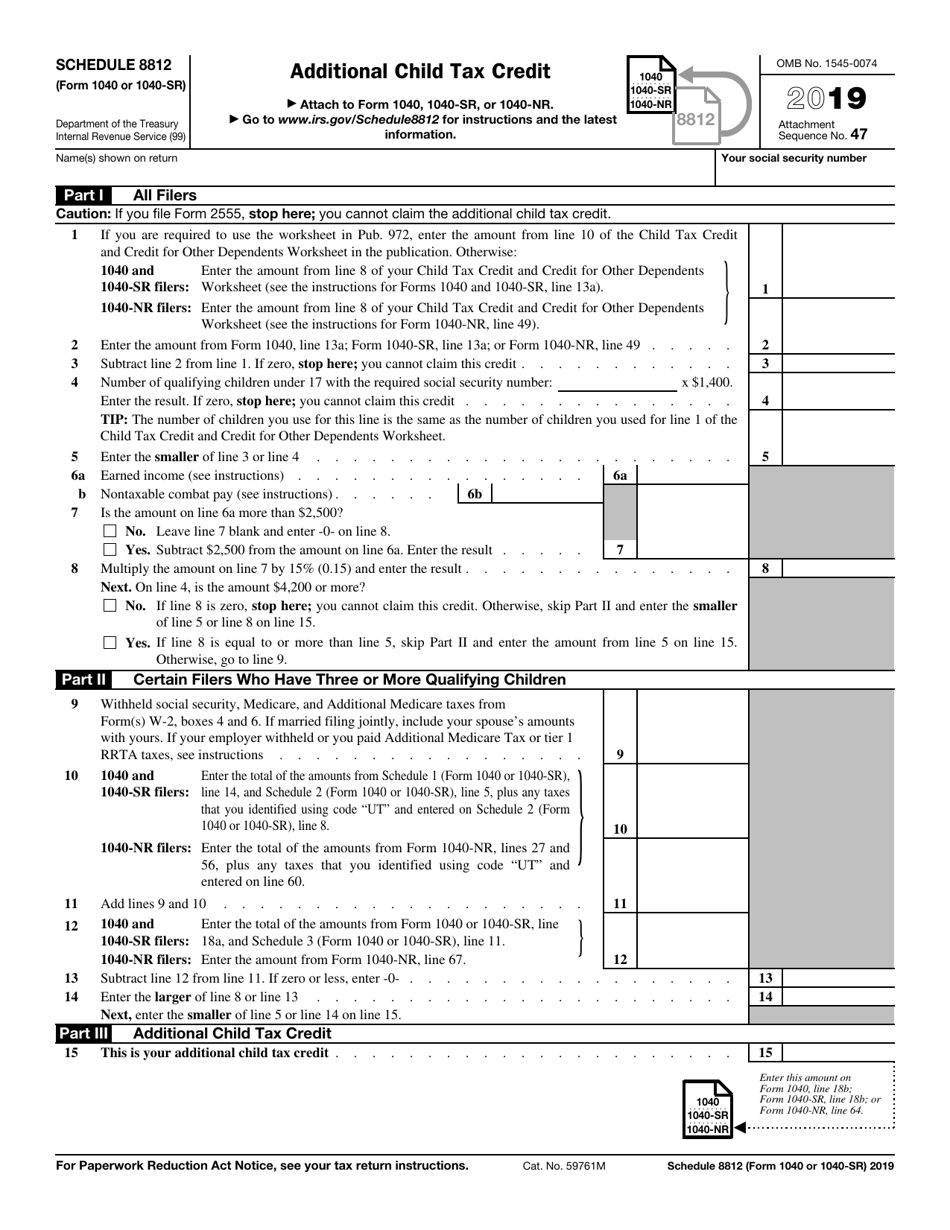

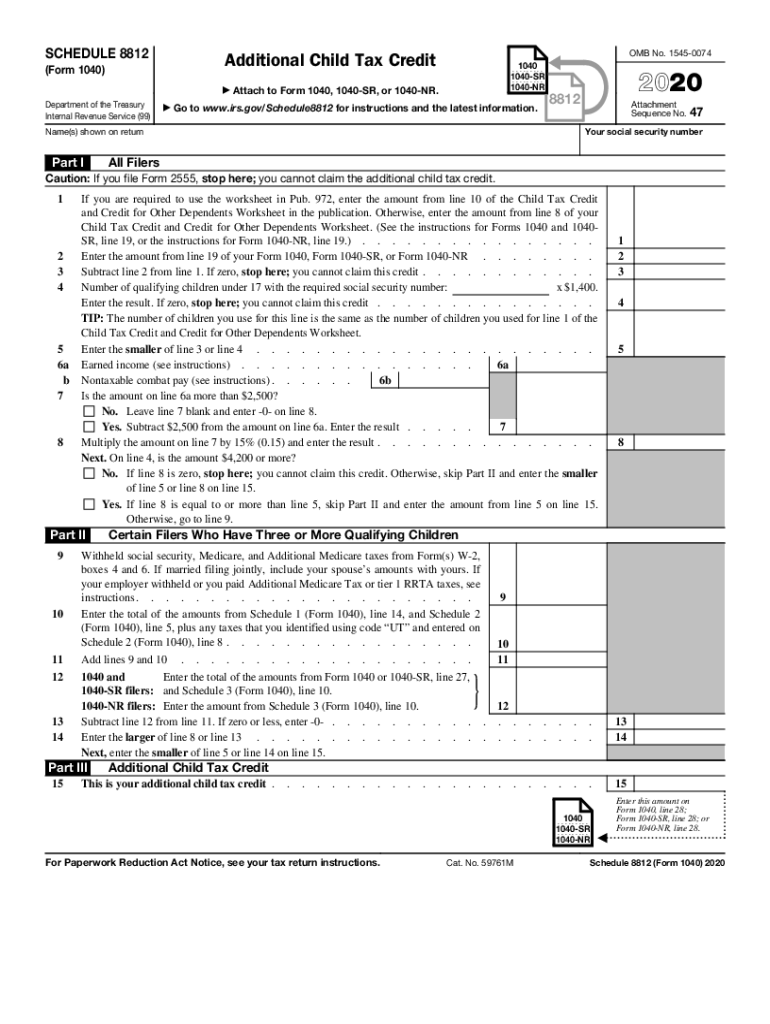

Calendar Year Return Projections by State 2019 Publ 6186. Additional Child Tax Credit 2020 Inst 1040 Schedule 8812 Instructions for Schedule 8812 Additional Child Tax Credit 2020 Form 1040 Schedule 8812 Additional Child Tax Credit 2019 Inst 1040 Schedule 8812 Instructions for Schedule 8812 Additional Child Tax Credit 2019. Depending on your income the 2019 Child Tax Credit Calculator could save you up to 2000 for each qualifying child.

The child was under age 17 at the end of 2019. The ACTC may give you a refund even if you do not owe any tax. Residential Energy Credits 2019 Inst 5695.

The exemption amount for a qualified disability trust increased to 4200 for 2019. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. For example in the United States only families making less than 400000 per year may claim the full CTC.

The premium tax credit for 2019 you don t need the information in Part II of Form 1095-C. Internal Revenue Service 2019 Instructions for Schedule 8812Additional Child Tax Credit Use Schedule 8812 Form 1040 or 1040-SR to figure the additional child tax credit ACTC. Citizen or resident alien.

Internal Revenue Service 2019 Instructions for Schedule 8812 Additional Child Tax Credit Use Schedule 8812 Form 1040 or 1040-SR to figure the additional child tax credit ACTC. These changes apply to tax year 2021 only. Families who qualify for the full 3000 or 3600 credit will see checks of 250 or 300 per child for six months.

When completing Part I only answer the questions with regard to children identified by an ITIN. The child did not provide over half of his or her own support for 2019. Advance Child Tax Credit payments.

Section references are to the Internal Revenue Code unless otherwise noted. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You may be able to use your 2019 earned in-come on line 6a to figure your additional child tax credit.

To file a tax return and. Section references are to the Internal Revenue Code unless otherwise noted. How to make changes with the IRS.

You will claim the other half when you file your 2021 income tax return. Annual Certification of Racial Nondiscrimination for a Private School Exempt From Federal Income Tax 2019 Form 5695. Using the 2019 Child Tax Credit Calculator.

You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. The IRS will use your 2020 or 2019 tax return details meaning your income and dependent information to estimate your amount for the advanced Child Tax Credit. For more information on who is eligible for the premium tax credit see the Instructions for Form 8962.

501 for more information about claiming someone as a dependent. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level. Review the table below to see what you can do.

If you need health care coverage go to wwwHealthCaregov to learn about. The IRS has created an online portal to allow families to make changes to the information on-hand. Instructions for Form 5695 Residential Energy Credit 2019 Publ 6149.

The child is claimed as a dependent on your return. Income to figure your 2019 earned income credit. Child Tax Credit CTC This credit is for individuals who claim a child as a de-pendent if the child meets additional conditions descri-bed later.

Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit. To qualify your child must. Starting in July the IRS will provide most parents between 3000 and 3600 for each child.

Form 1040 Earned Income Credit Child Tax Credit Youtube

How To Fill Out Irs Form 8962 Accounts Confidant

Irs 8812 2011 2021 Fill Out Tax Template Online Us Legal Forms

Aca Affordable Care Act Information Vita Resources For Volunteers

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

Irs Form 1040 1040 Sr Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2019 Templateroller

Irs 1040 Schedule 8812 2020 2021 Fill Out Tax Template Online Us Legal Forms

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

Irs Form 1040 1040 Sr Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2019 Templateroller

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Child Tax Credits Form Irs Free Download

Irs Form 2441 Download Fillable Pdf Or Fill Online Child And Dependent Care Expenses 2020 Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)