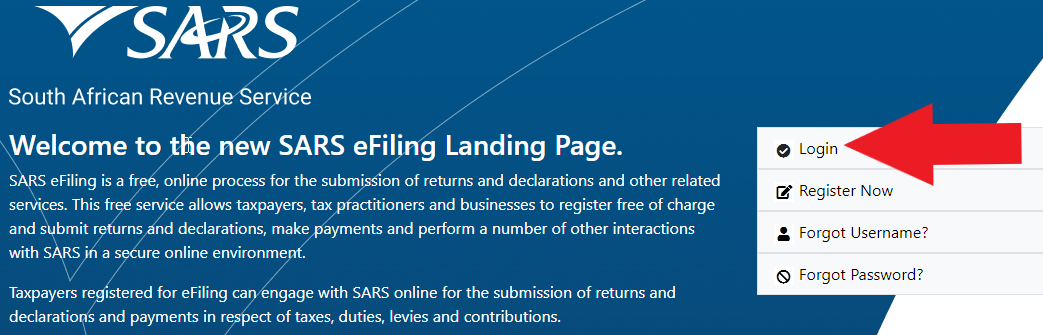

More so you would be required to provide the details of your organisation if you are a representative of one and if your employment is full-timepart-time your employers details would be required. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment.

Tax Season South African Revenue Service

0800 hrs - 2000 hrs.

E filing sars 2020 opening date. 2021-22 SARS eLogbook for the 1 March 2021 28 February 2022 assessment year and filing season starting 1 Jul 2022 2020-21 SARS eLogbook for the 1 March 2020 28 February 2021 assessment year and filing season starting 1. Taxpayers who wish to file online are expected to file from September 1 2020 to November 16 2020. Monday October 19 2020 Individual taxpayers who wish to file their personal income tax return at a South African Revenue Service branch have until Thursday to do so.

Taxpayers who cannot file electronically can do so at a SARS branch by appointment from September 1 2020 to October 22 2020. Phase 1 April 15 to May 31 2020 Employer and third-party filing. Non-provisional taxpayers If you are visiting a SARS branch to file your tax return you can file from 1 September 2020 and the deadline for filing is 22 October 2020.

SARS eFiling is a free online process for the submission of returns and declarations and other related services. Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. Filing season postponed and other tax matters As a relief measure during the Covid-19 pandemic the South African Revenue Service hereafter SARS has announced that the tax filing season has been postponed to the 1st of September 2020 and is.

Here are the filing dates for individuals as stipulated by the SARS. The firm added that provisional taxpayers and other taxpayers who were not auto-assessed can start submitting their returns from 1 September 2020. SARS has put in place a three-phased approach.

However as a result of the amended Sars dates for 2020 tax submissions for individuals the 2020 tax filing season will only be opening as from September 1 this year. 22 October 2020. This applies to third party institutions like banks and insurance companies.

Taxpayers who cannot file online can do so at a SARS branch by appointment only. Tax filing season to open in August Thursday June 25 2020 The South African Revenue Service SARS has announced that the 2020 Filing Season will begin on 1 August 2020. Phase 1 Employer filing 15 April to 31 May 2020 A renewed focus will be placed on Employers to be fully compliant in terms of their filing and payment obligations ie.

Part two of the plan occurs. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Closing date for taxpayers who cannot file electronically can do so at a SARS branch by appointment.

1800 103 0025 or 1800 419 0025. 1 July to 23 November 2021. SARS has designed the filing season 2020 for personal taxes covering 3 phases.

Monday to Saturday e-filing and Centralized Processing Center. If you are filing your tax return via eFiling you can file from 1 September 2020 and the deadline is 16 November 2020. He further said the closing date for tax payers who wanted to file at a Sars office which will require an appointment is 22 October 2020 while the closing date for e-filing is 16 November 2020.

1 July to 31 January 2022. The employer annual reconciliation process. New auto-assessments will be issued in August and filing opens in September 29 June 2020 - 1720 Laura du Preez The South African Revenue Service will send you an SMS in.

Then a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim. You may make use of the SARS eLogbook simply download the. Closing date for taxpayers who file.

Part one refers to the period of employer filing between 15 April and 31 May 2020. Taxpayers who file online.

It Starts With Auto Submission Sars Filing Your Return For You And Is Only A Provisional Assessment That You Assessment Indirect Tax Financial Statement

Estimate Your 2017 Tax Refund With The 2016 Return Calculator What Is Filing Of Income Tax Return Tax Refund Income Tax Return Federal Income Tax

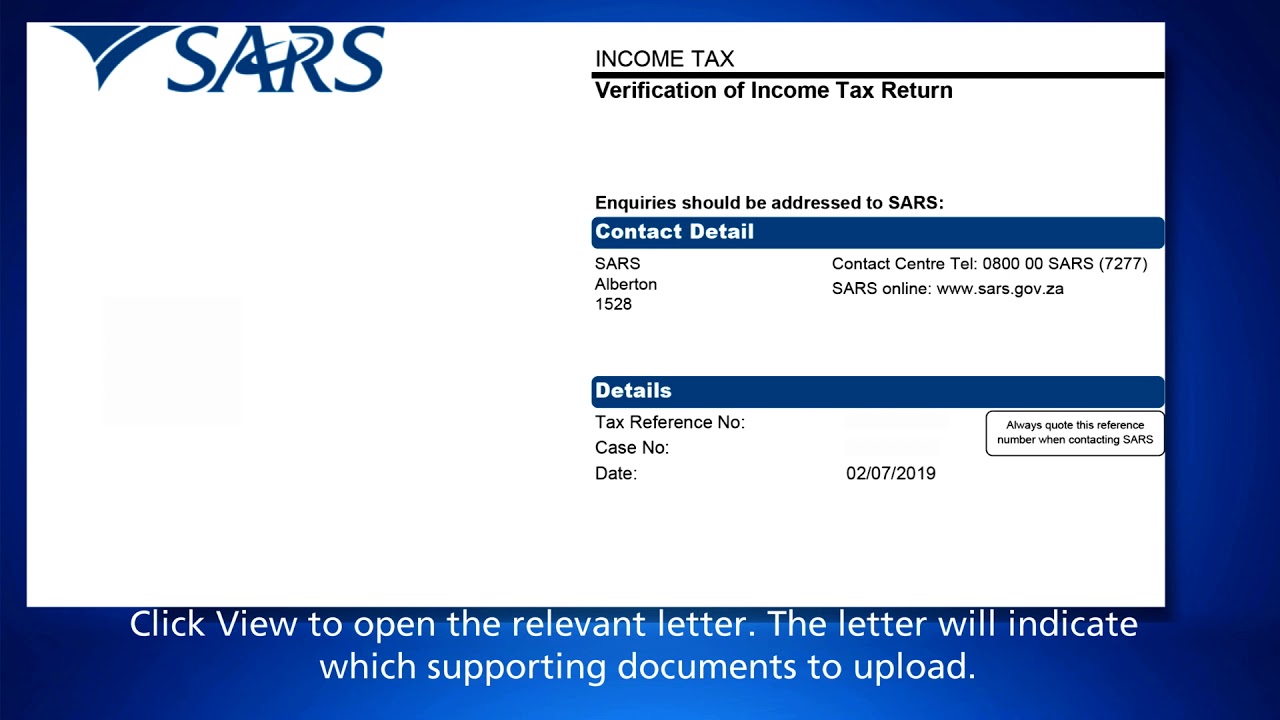

Sars Efiling How To Submit Documents Youtube

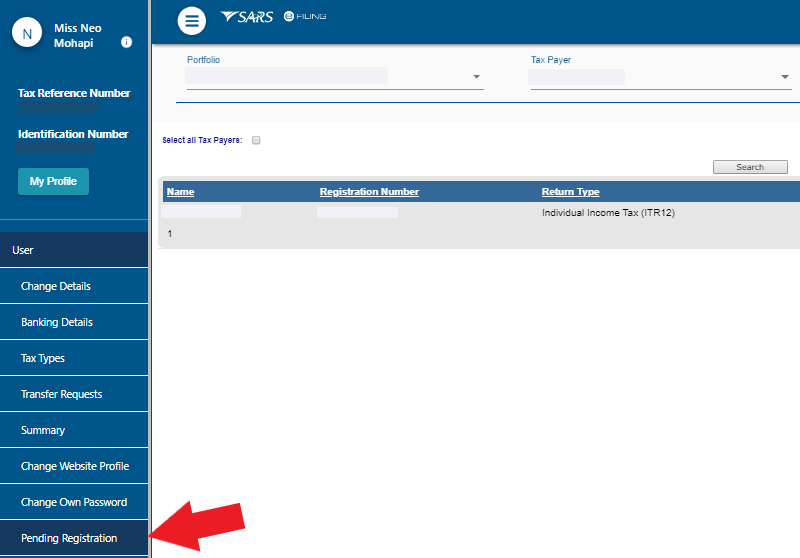

Is My Sars Efiling Profile Still Being Verified Taxtim Sa

Pin On Free Streaming Movies Tv Shows Live Tv News Guides

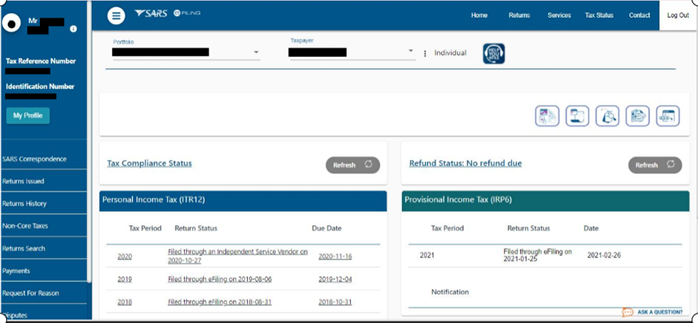

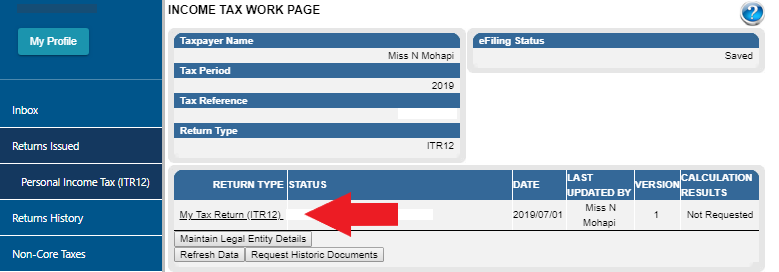

Sars Efiling How To Submit Your Itr12 Youtube

Pin On Happening Now In South Africa

How To Update Your Sars Registered Details On Sars Efiling Youtube

Sars Efiling How To Register Youtube

E Filing File Your Malaysia Income Tax Online Imoney Income Tax Returns E Filing In 2020 Online Taxes Income Tax Income

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Tax Season South African Revenue Service

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Advertising Online Business What I Found When I Checked Out Infinity Traffic B Internet Business Opportunities Online Business Opportunities Internet Business